Contrary to initial fears of an economic downturn, due to high inflation and rising interest rates, the cloud computing market shows no signs of slowing down. Quite the contrary, according to PMR’s latest analysis, cloud spending in 2023 has once again reached a record high, increasing year-on-year nominally by PLN 1 billion.

The pace of cloud deployment has not slowed down

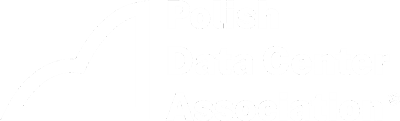

According to PMR’s latest report, the total value of the cloud computing market in 2023 will reach PLN 3.9 billion, a 34% year-on-year increase. The potential for further growth in the coming years remains evident. PMR’s forecasts for 2024 show that the cloud market is expected to grow to PLN 4.8 billion in 2024, and to approach PLN 13 billion in 2029.

| 2021 | 2022 | 2023 | 2024p | 2029p | |

|---|---|---|---|---|---|

| Value (PLN billion) | 2,2 | 2,9 | 3,9 | 4,8 | 12,9 |

| Dynamics (% y-o-y) | 31% | 29% | 34% | 24% | Null. |

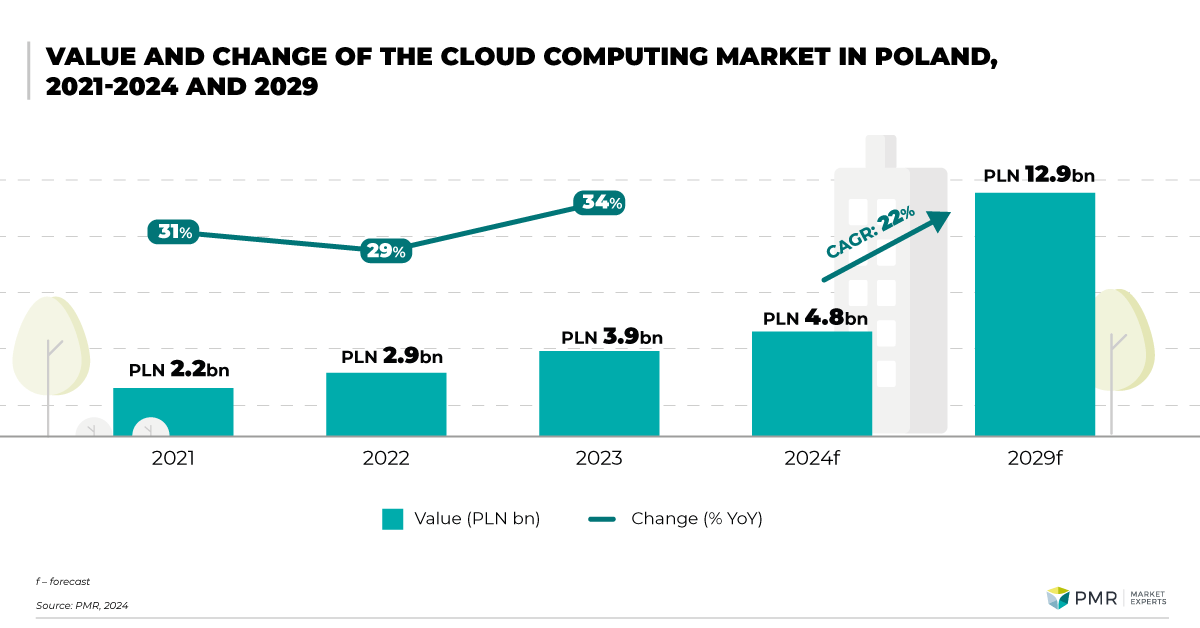

There is also no change in the attitude of large companies in Poland when it comes to planned spending. Fewer than one out of 100 companies say they want to cut back on cloud spending. The use of cloud computing is associated with ever-increasing costs, which are not always dictated solely by new projects and investments, but also by changes in the pricing policies of cloud providers. Nor can we forget about technological innovation. The use of artificial intelligence in organizations is set to become one of the top priorities.

Another important factor that opens up new prospects for the cloud computing market is also the development of infrastructure in Poland, including data centers and networks, including mobile (5G) and fixed (FTTx) access. It will become possible to collect data from devices, send it to the cloud and receive real-time feedback. The infrastructure expansion will lay the groundwork for a range of new applications that were not available with older technologies.

Infrastructure investments of hyperscalers

Investments by major hyperscalers in existing cloud regions, as well as those planned, play an important role in the context of the growing data center market, which is able to scale to a much higher level, in terms of the power resources used to power cloud servers. The decisions of Google Cloud Platform and Microsoft to locate cloud regions in Poland based on data centers located in the country and cooperation with local partners, both in terms of colocation services and deployment projects, are a prime example.

AWS has decided to launch a zone, but a region in Poland in the future is not out of the question either. The activity of the world’s three largest IaaS providers and their investments in Poland show how important the domestic market is for them now and how important it is from the point of view of at least some customers to locate physical infrastructure in Poland.

The hyperscalers also want to address especially regulated industries, for which minimizing risks about processing data outside a domestic location is a priority. It is not that regulations do not allow processing outside Poland, but they still leave room for interpretation, making companies and institutions unwilling to risk unnecessary disputes with regulators.

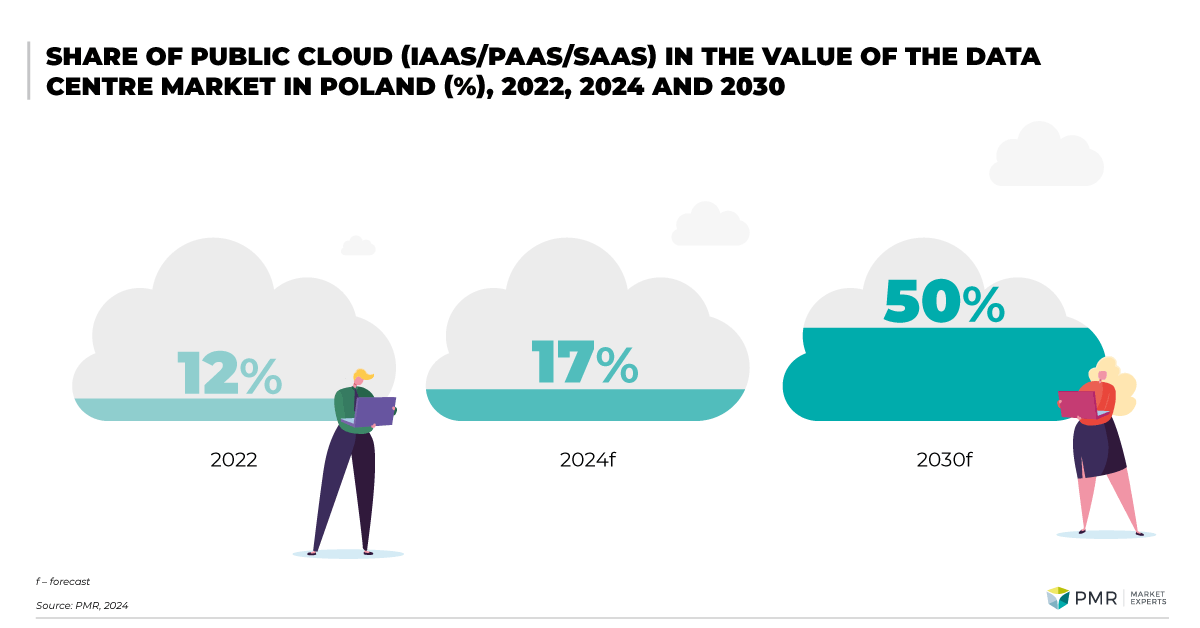

PMR’s forecasts indicate that the share of the public cloud in the total value of the data center market in Poland will increase threefold between 2024 and 2030, reaching 50% by the end of the forecast period.

| 2022 | 2024p | 2030p | |

|---|---|---|---|

| Public cloud | 12% | 17% | 50% |

In parallel with the market shaped by global public cloud providers, who are increasingly competing on the added value derived, for example, from the AI functionality they provide, there is a growing market of providers focused on managing multiple platforms and integrating public cloud services with corporate data centers. The needs of business in this area will grow. The growth of hybrid and multi-cloud environments, as well as consulting, deployment or integration services in the area of cloud computing, is an important trend. This is an opportunity for service providers and data centers operating locally.

Cloud as an EU priority

At the same time, it should be borne in mind that even despite the high level of penetration already achieved, cloud computing will continue to be one of the main areas of budget allocation by companies in the coming years. This is indicated, among other things, by the European Commission’s new agenda, “Path to the Digital Decade”. According to its assumptions, by 2030 a minimum of 75% of European companies should use cloud-based solutions. At the same time, during the forecast period, it is expected that further initiatives – related, for example, to the development of a sovereign European cloud – will gain in importance. This only confirms that the current direction of the market in the coming years will be maintained.

Methodological remarks

The material was prepared on the basis of PMR’s reports: “Cloud computing market in Poland 2024. Market analysis and development forecasts for 2024-2029” and “Data center market in Poland 2024. Market analysis and development forecasts for 2024-2029“.

For the purpose of the reports, PMR conducted a survey on a sample of 500 large companies and SMEs in Poland. The survey was conducted in Q1 2024 using computer-assisted telephone interviewing (CATI) techniques.