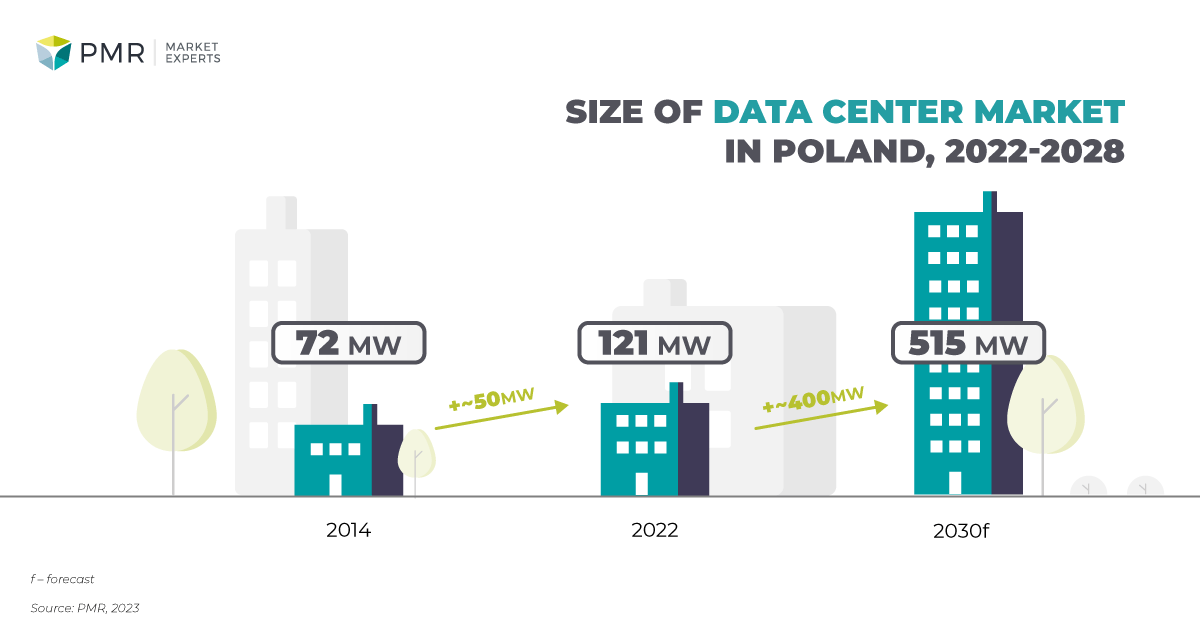

PMR forecasts based on mapped investments of the largest providers, as well as announcements and plans of new players, indicate that the limit of 500 MW of Polish data center capacity will be exceeded in 2030. The development of public cloud as well as dynamic technological advances, especially in the area of artificial intelligence, imply an increased demand for servers and computing power. This translates into growth potential for the domestic data center market.

PMR’s latest forecasts show that the implementation of plans by Poland’s largest data center providers could result in a maximum increase in commercial server room capacity of more than 400 MW from around 120 MW in 2022. It should be emphasized that this is an optimistic scenario, that does not take into account the typical market phasing of investments. The seven-year perspective seems realistic, although the likelihood of each market player’s plans being realized varies and must be considered on a case-by-case basis.

We continue to expect a gradual increase in the demand for colocation services in the country and the appearance of new foreign customers on the market. The market will increasingly be divided into two parts: wholesale and retail. The size of the market in terms of the providing power and space in hyperscale data centers will also increase.

In practice, large investment projects mean selling in a wholesale model and contracting customers even before the construction process is completed. In our opinion, the increasing concentration of capital in Poland and the arrival of new investors is the most important factor in the development of the market in the next few years, which will significantly increase the level of revenues from data center services.. It is impossible to assume that the entire list of large investment projects being pursued and planned by large investors is calculated other than to achieve a reasonable return on the allocated funds within a reasonable period of time.

The list of data center service providers operating in Poland and targeting the wholesale market includes the French group Data4, which will open its first data center in Poland in 2023, as well as operators previously known mainly for serving the retail market (Atman, Equinix Poland).

The so-called hyperscalers, i.e. wholesale customers such as Google, Amazon, Microsoft, Apple and Meta, are very important for the data center market. Google has had a cloud region in Poland since 2021 and uses infrastructure prepared specifically for its needs by providers with data centers in Poland. Microsoft, on the other hand, officially launched the region in Q2 2023, based on three autonomous data centers. Two of them were built and operated by an external partner for Microsoft’s exclusive use.

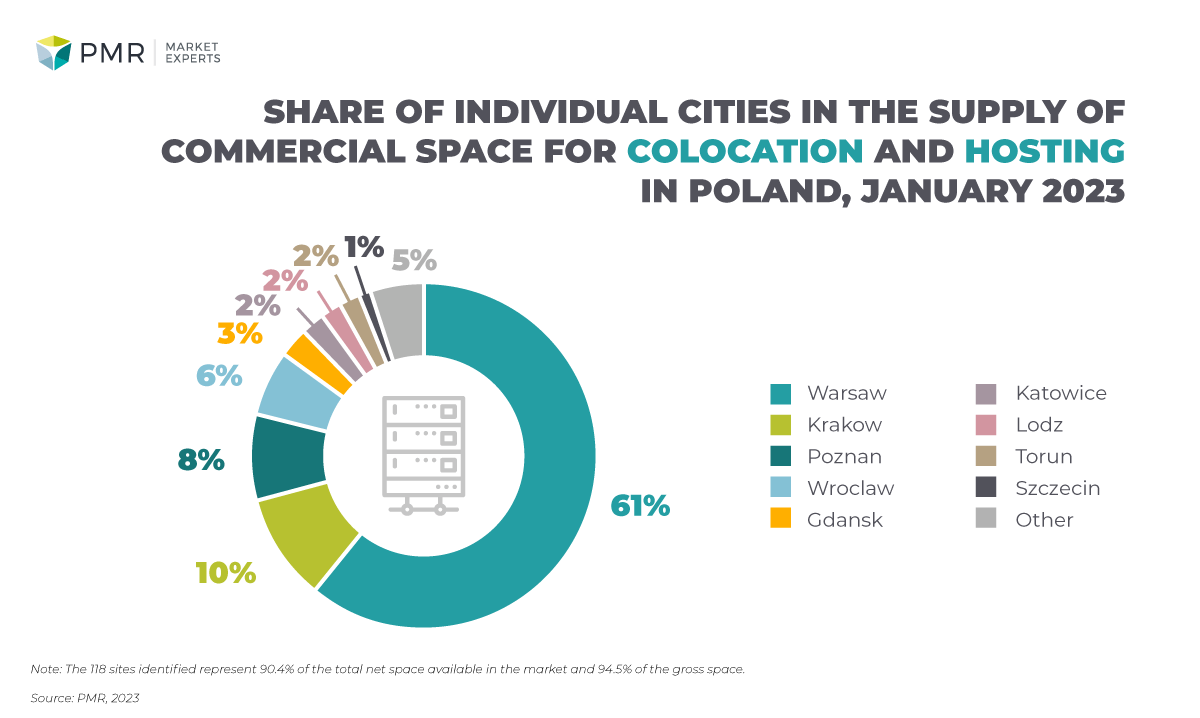

Dominance of Warsaw

Warsaw accounts for more than 60% of the total commercial server space in Poland. Almost 10% of the net space is located in Krakow and 8% in Poznań. The latter holds a strong position among alternative locations to Warsaw mainly due to Beyond.pl. Gdańsk, which last year gained a new commercial facility with 3S Data Center (Play Group), has moved up the list of locations.

Investments planned for the near future indicate that Warsaw’s share will continue to grow. Warsaw generates by far the highest demand for data center services, including colocation. However, it is also the most competitive and demanding market, where success is determined by experience and a comprehensive offer. On the other hand, centers in other locations are playing their part, although the scale of such investments is different. In the context of the war in Ukraine, georedundancy, which allows access to an alternative data center much further away from the primary server room than the 15-20 km within the Warsaw metropolitan area, is gaining importance. This is a trend forced by the geopolitical situation.

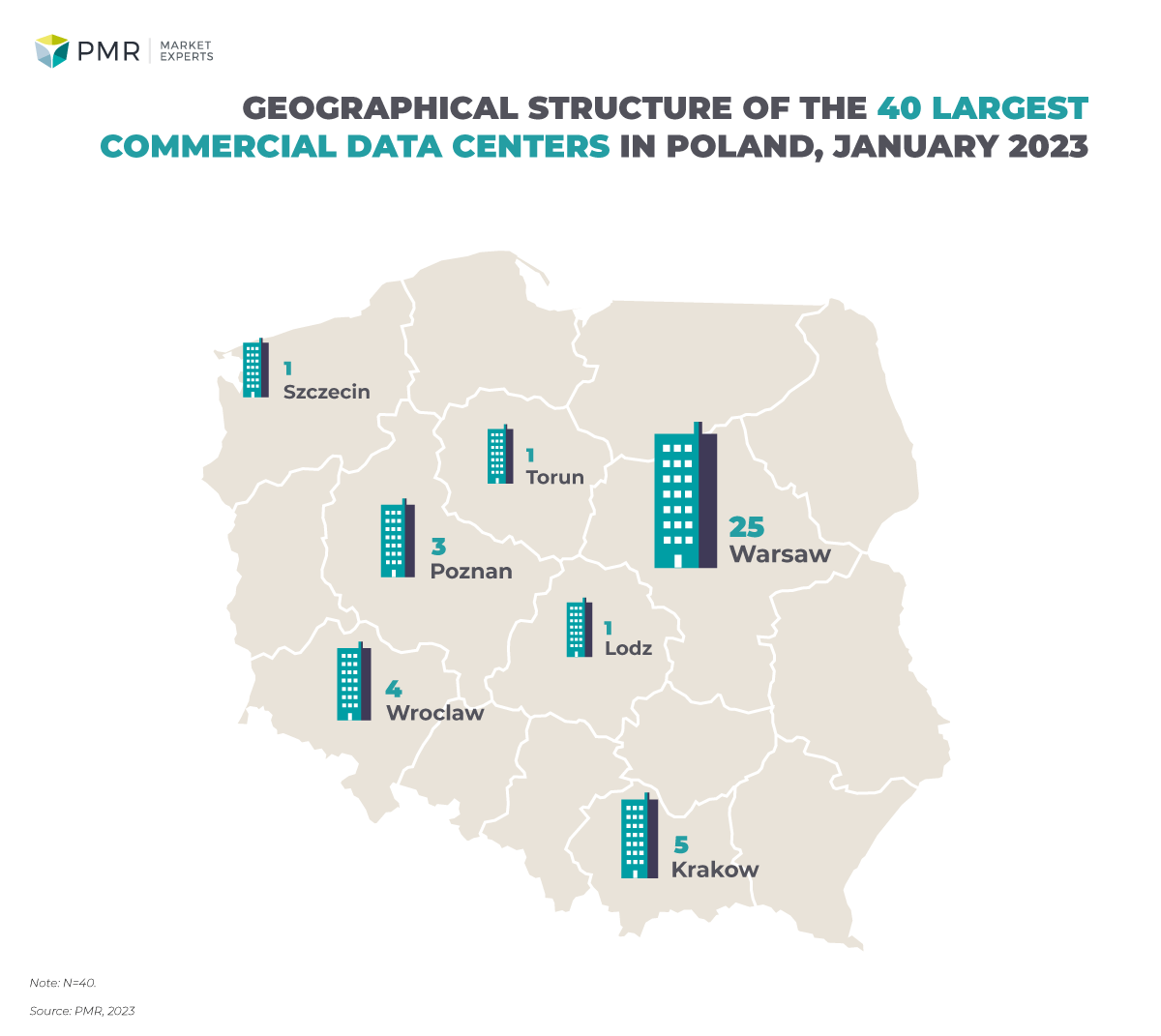

The results of the location analysis of the top 40 commercial data centers confirm the dominance of the Warsaw location, which occupies 25 out of 40 places on the list of leading CPD facilities in early 2023

Corporate spending on data center services is on the rise

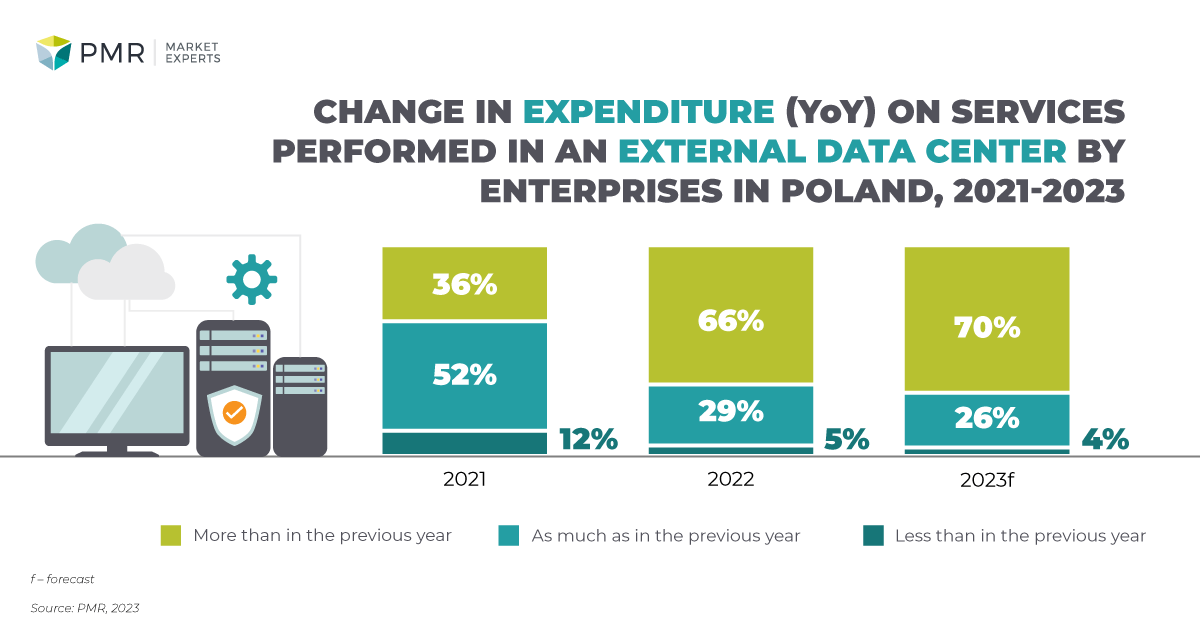

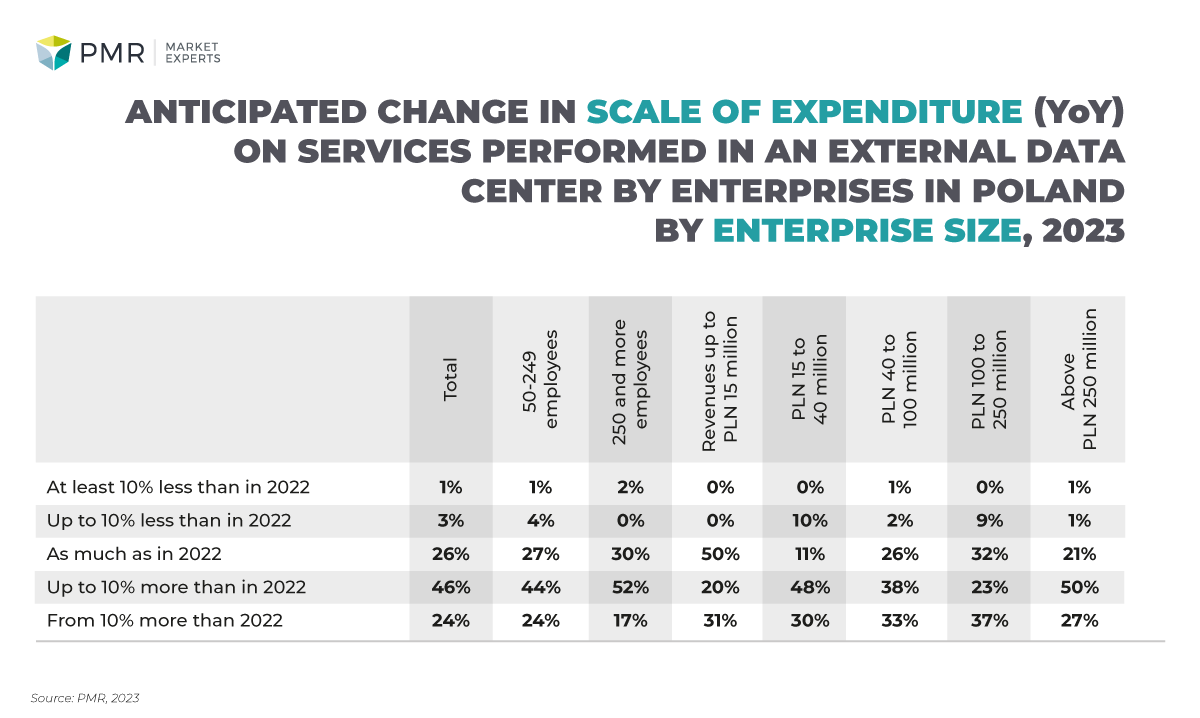

This year’s PMR research shows that two-thirds of enterprises have increased spending on data center services in 2022 compared to 2021, and this percentage will continue to increase in 2023. Only 4% of enterprises plan to spend less on these services than in 2022. By contrast, the expected change in the level of service spending in 2023 varies by company size, but as many as 70% of companies plan to increase spending again, with 24% planning to increase spending by more than 10%.

Sustainable development

Data center services providers in Poland are generally becoming i more and more aware of the need to switch to green enenrgy, also for image reasons and in connection with so-called sustainability. This is also a response to the changing EU climate policy. They are mostly opting for energy from renewable sources, such as photovoltaic and wind farms. Polish datacenters are increasingly signaling directly to their customers that the energy they use comes from renewable sources. This is confirmed by certificates and guarantees from the energy providers.

Atman is committed to using only green energy to power its facilities as of January 1, 2023. In addition, at Atman’s largest campus in Warsaw, the water used for cooling is in a closed circuit. This, by the way, is standard practice for the biggest players in the market.

Beyond.pl, which also uses 100% renewable energy, is very active in this area. Heat recovered from the server room is used to heat the office premises. Beyond.pl also uses adiabatic cooling, i.e heat exchangers supported by water evaporation.

One of the leaders in the global data center market, Equinix, also takes sustainability very seriously. The provider uses only green energy and has a number of other initiatives focused on sustainability.

Data4 also takes sustainability seriously and systemically. Its approach begins at the design stage, with in-depth life cycle analysis (LCA), through the construction and operation of infrastructure, using low-carbon concrete, waste heat recovery projects and innovative cooling technologies.

Poland leads countries in the region

In 2023, PMR has analyzed the data center market in the Czech Republic, Croatia, Greece, Romania, Slovakia and Hungary. According to PMR, Poland has the largest data center market in terms of power supply and value among the countries analyzed. At the same time, the projected market growth in Poland between 2023 and 2028 is the highest. As a result, Poland will only strengthen its leadership position clearly position itself as a colocation hub and key data center location in this part of Europe.

Virtually every major player is building new facilities or has plans to do so. In Q4 2023, Atman, which aims to provide customers with 43MW of IT capacity, officially kicked off with a new investment of more than EUR 300 million. Even more capital for investment in Poland will be available to Data4, which reported that it has raised EUR 2.2 billion in financing, of which EUR 500 million is exclusively for the Polish market.

Large investment projects already mean sales in a wholesale model and not infrequently to contracted customers even before the construction process has started. In our opinion, the increasing concentration of capital in Poland and the arrival of new investors is the most important factor for the development of the market in the coming years. Another factor is the expansion of solutions and services based on artificial intelligence, which significantly increase the revenue level of data center services . AI requires server resources and data centers, but is not as demanding in terms of location, which means that Poland’s data center valley, including those of a hyperscale nature, can extend much further from Warsaw.

The material uses data from PMR’s latest report:

Data center market in Poland 2023

Market analysis and development forecasts for 2023-2028. Impact of inflation and war in Ukraine